Table of Contents

ToggleWhat is an IPO? Understanding the Basics

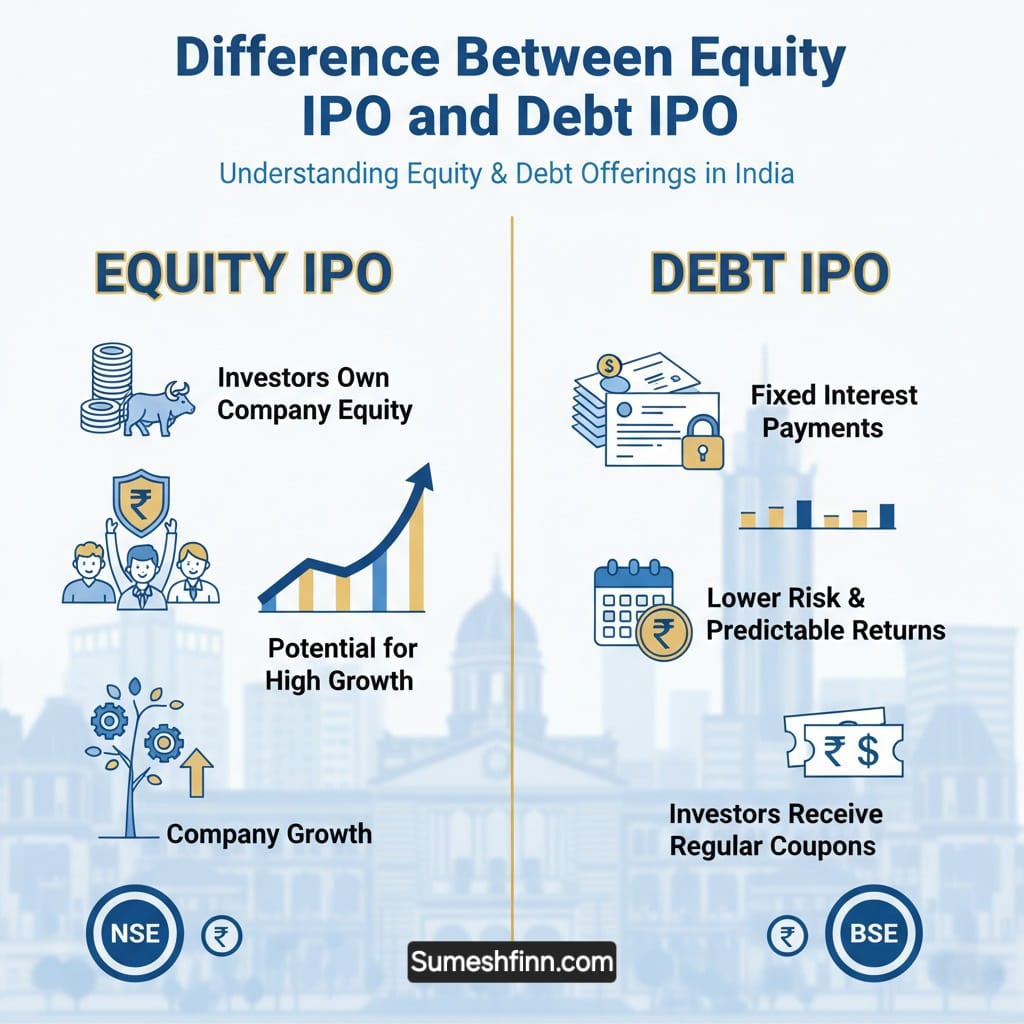

An Initial Public Offer (IPO) is an important step in a company’s journey. It is the process where a private company sells its securities, such as shares or bonds, to the public for the first time and becomes a publicly listed entity.

By launching an IPO, a company can raise money from investors to support its growth, pay off debt, or meet other business goals. IPOs fall into two main categories based on the type of securities issued:

- Equity IPO – when the company sells shares to the public.

- Debt IPO – when the company sells bonds or debentures to the public.

What is an Equity IPO?

An Equity IPO occurs when a company raises money by selling its shares to the public for the first time. Investors who buy these shares become partial owners of the company. They gain rights such as voting power and can earn profits through dividends or capital appreciation.

Purpose of an Equity IPO

Companies usually go public to:

- Raise long-term money for business expansion or upgrades.

- Improve their financial structure by lowering debt.

- Offer liquidity and exit options to existing investors or promoters.

- Increase their market presence, credibility, and brand reputation.

Types of Equity IPO

- Fresh Issue:

The company issues new shares to raise new capital. The money generated goes directly to the company, increasing the total share capital.

- Offer for Sale (OFS):

Current shareholders, like promoters or venture capitalists, sell some of their shares to the public. The money raised goes to the selling shareholders, not the company.

- Combination Issue:

This involves both fresh capital and an offer for sale.

Who Can Invest in an Equity IPO?

The company issues new shares to raise new capital. The money generated goes directly to the company, increasing the total share capital.

Current shareholders, like promoters or venture capitalists, sell some of their shares to the public. The money raised goes to the selling shareholders, not the company.

- Combination Issue:

This involves both fresh capital and an offer for sale.

What is a Debt IPO?

A Debt IPO happens when a company raises funds by issuing debt instruments like bonds or debentures to the public. These instruments represent a loan from investors to the company and do not confer ownership.

Investors in a debt IPO receive fixed interest (coupon) at regular intervals and get their principal back at the end of the term. Debt IPOs are typically favored by conservative investors looking for steady income with lower risk

Purpose of a Debt IPO

Companies issue debt securities to:

- Raise funds for working capital or infrastructure projects.

- Refinance existing loans at better interest rates.

- Broaden their funding sources beyond traditional bank loans.

Types of Debt IPO

- Secured Debentures/Bonds:

These are backed by the company’s assets, offering lower risk and lower returns.

- Unsecured Debentures/Bonds:

These are not backed by any specific asset, carrying higher risk but offering higher interest.

- Convertible Debentures:

These can be converted into equity shares after a set period, combining the safety of debt with equity potential.

- Non-Convertible Debentures (NCDs):

These are purely debt instruments that cannot be converted into shares. They provide fixed interest and return the principal at maturity.

Conclusion

Both Equity IPOs and Debt IPOs are key parts of India’s capital market system.

- Equity IPOs are best for investors who believe in a company’s long-term growth and are willing to accept higher risks.

- Debt IPOs are better suited for conservative investors looking for regular income and capital protection.

Understanding the difference between these two helps investors make informed choices that match their financial goals and risk tolerance.